Key Concepts

What is LedgerSwarm?

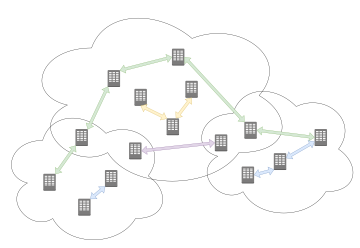

LedgerSwarm uses the RLN Protocol to allow single and multiple parties to connect, synchronize and settle assets and liabilities between different ledgers.

How does LedgerSwarm work?

By utilising SETL's financial markets and technical knowledge we have be able to create a bespoke consensus algorithm which places all transactions in a logical sequential order, devises the best settlement route, schedules responses and then commits the transaction when all parties agree. The algorithm also takes into account defined roles, functions and restraints as required in regulated financial markets. The core underlying technology languages are Java and JavaScript and by leveraging our distributed ledger technology (DLT) knowledge the LedgerSwarm team have been able to implement a one-of-a-kind smart contract framework with an inbuilt API and Kafka based integration layer capable of interfacing with all internal and external ledger networks.

The Regulated Liabilities Network (RLN)

The RLN is a distributed ledger network that provides a mechanism for regulated entities to settle transactions in real-time. In particular, the RLN could be a new FMI (Financial Market infrastructure) with the following unique characteristics:

- 24x7 to enable a follow the sun model

- Programmability to allow transfer of funds via smart contracts outside working hours

- A permissioned shared ledger system which records, transfers, and settles regulated liabilities

- Wallet system which allows participants to manage and store tokenized money and assets

LedgerSwarm and the RLN

LedgerSwarm is the building block of a Regulated Liability Network and is capable of being used both intra and inter organisationally. In it's broadest sense it is a distributed ledger network that provides a mechanism for regulated entities to settle transactions in real-time.

Advantages of LedgerSwarm

LedgerSwarm provides a mechanism for regulated entities to take part in a global network of tokenised regulated liabilities.

Whilst such regulated liabilities exist today and are held and traded through a variety of mechanisms, Ledger Swarm provides the following novel functionality:

- All liabilities will be recorded on a single network.

- Balances will be available to participants through a wallet system.

- End-user transactions will leverage a mapping of participant ledgers to atomically update two or more participant balances to settle transactions.

- Participant-only privacy model.

- LedgerSwarm facilitates programmable contracts.

- The atomic update of all ledgers will occur in real-time.

- Settle across private domains or public network.

The essence of any settlement is that the Ledger entries for all involved parties be updated to reflect the effect of that settlement. The function of LedgerSwarm is, for any transfer, to resolve the parties and accounts that must be updated and then to organise an atomic settlement between those parties.

The parties to any particular settlement may be entirely within a protected or public domain or span both public and private domains. The settlement path may be of an arbitrary length – the network does not impose any limitation in this respect, the only requirement is that each participant be able to provide settlement details for a proposed transaction in a coherent manner that allows for a settlement path between sender and beneficiary to be established.

LedgerSwarm also operates alongside existing account-based infrastructures and there are efficient mechanisms for integration between LedgerSwarm and traditional accounts.

Key Elements

Partitions

- The LedgerSwarm application (and the RLN) is comprised of a collection of issuer 'partitions'. An issuer (partition operator) can be a bank, a commercial bank, or any institution that wishes to record a liability of that institution as a token in favour of a token holder. The activities of the partition operator will be subject to appropriate regulation, thus being a regulated liability.

- The RLN shared ledger allows participating institutions to record their liabilities as being part of the network and for the network to act directly on those liabilities. In this way, the money is "in" the network, and the network can operate continuously and make the final settlement.

Instruments

- Private and public money are considered 'regulated liabilities' meaning that they are promises by the central bank, private banks and non-banks to pay the user on demand at par value in national currency units, i.e., the balance in an user's account is backed by a promise that the bank will provide GBP notes should they wish to redeem.

- This is identical to liabilities on the RLN which are promises to deliver an instrument to the token holder, i.e. a GBP token issued by a commercial bank is a promise to pay GBP if the holder wishes to redeem it. Liabilities or promises are denominated in a core instrument which has a primary issuance partition. The primary partition for GBP tokens is the central bank and in essence all tokens recorded in that partition are, by definition, Central Bank Digital Currency (CBDC).

Transactions

- The RLN serves as a medium to allow token holders to execute transactions, i.e., transfer value from one partition to another. The appropriate route for this transaction is determined by the RLN and dependent on the relationship between partition operators, as a result multiple partitions may need to be updated. For example, if two partition operators are both token holders in a common partition (e.g., in a central bank partition), the RLN can move tokens from a sender in one the partitions to a receiver in the other partition. This activity will result in a liability being extinguished on the sender's partition and the creation of a liability in the receiver's partition, in token terms this activity is known and burning and minting. The agreement of the receiving partition to take on a new liability depends upon it receiving a token in the common partition from the sending partition. In this way, participants in the RLN can allow their token holders to effect a value transfer to the customers of any other participants in the RLN.

-

This is like the correspondent banking system in place today however the RLN co-ordinates the minting, burning and movement of tokens real time, into an atomic transaction which executes simultaneously across the network. Ultimately each partition operator has the final say on whether a transaction is processed with all partitions involved in a transaction (and only those involved) coming to a consensus before it is finalized.

-

Since balances are managed within network, the RLN is uniquely able to atomically perform multiple ledger changes for the completion of a transaction in a consistent manner and in real-time.